Co-browsing technology (collaborative browsing) uses an authenticated environment to enable dual control of a browsing session. This allows the advisor to assist a customer directly on a website, online application or document in real-time. Co-browsing helps to deliver a high-touch interaction, thereby improving customer satisfaction and engagement so that the same issue is less likely to occur in the future.

Discover more about the nuts and bolts of co-browsing here.

Types of Co-BrowsingCo-browsing is a dynamic solution that can adapt to unique customer-agent situations. Different types of co-browsing tools make it malleable for use across wealth management, retail banking and insurance environments.

The View & Highlight tool gives an agent access to the customer’s screen. This helps to provide visual context to the customer’s problem. From there, they can use the highlight tool to draw attention to different areas on the screen, providing a visual aid as they talk the customer through the issue.

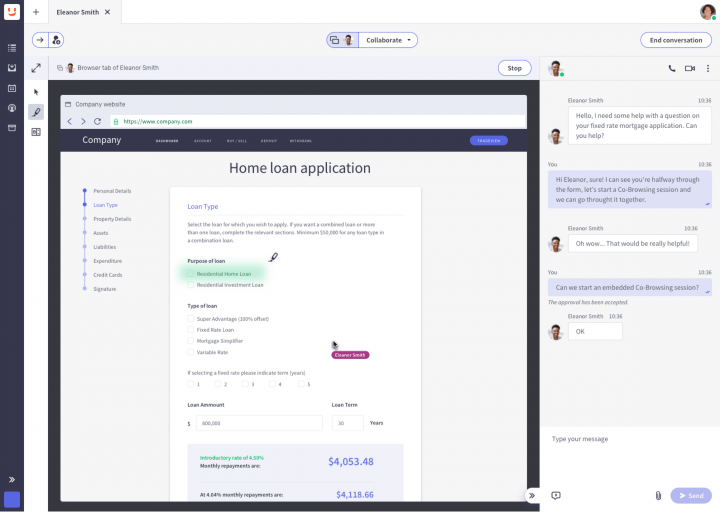

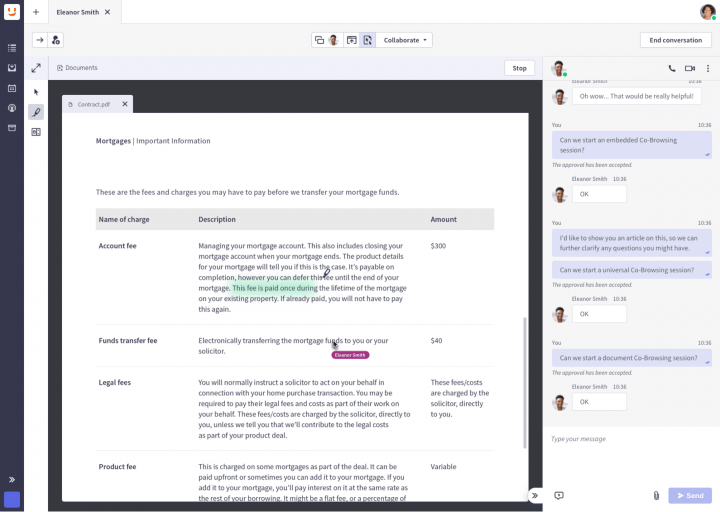

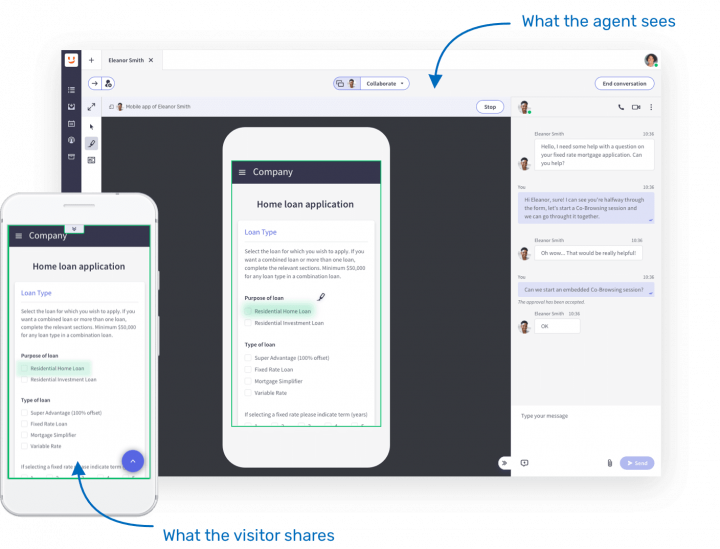

Embedded Co-browsing is for agent-customer collaboration on an online platform or application, like an e-banking portal. This facilitates dual control of the screen for any tasks carried out within the online self-service environment.

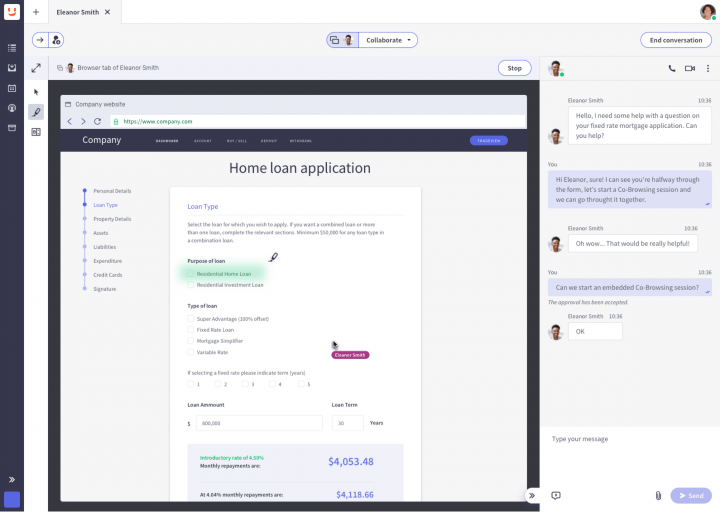

Universal Co-browsing tools give the agent and customer additional flexibility to simultaneously browse external websites anywhere on the web. In situations where collaborative research or a quick reference is required, universal co-browsing ensures a seamless and safe customer experience.

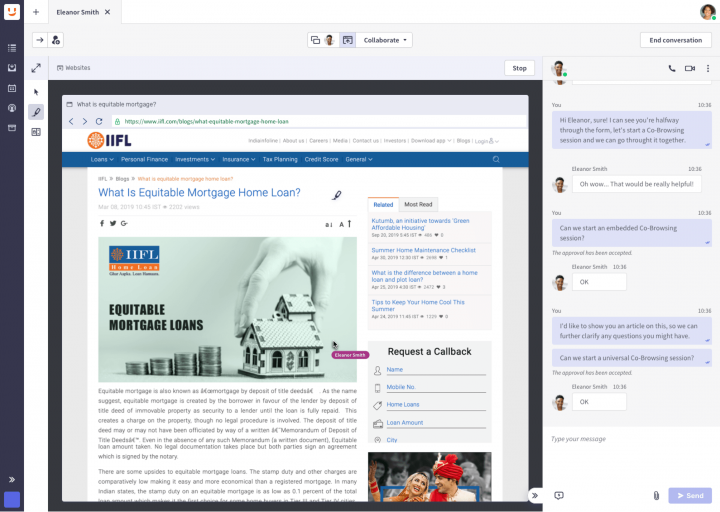

Document Co-browsing is a solution for collaboration on complex forms, documents and contracts. With dual control, agents can help customers to fill out each form field and guide them through any tricky process, creating a high-touch and personalized experience.

Unblu’s mobile SDK powers Mobile Co-Browsing, which lets financial institutions natively integrate co-browsing into their apps or create a unique application. With all the same functionalities as the desktop version, Mobile Co-Browsing makes collaboration services ultra-accessible from an e-banking app on a mobile device.

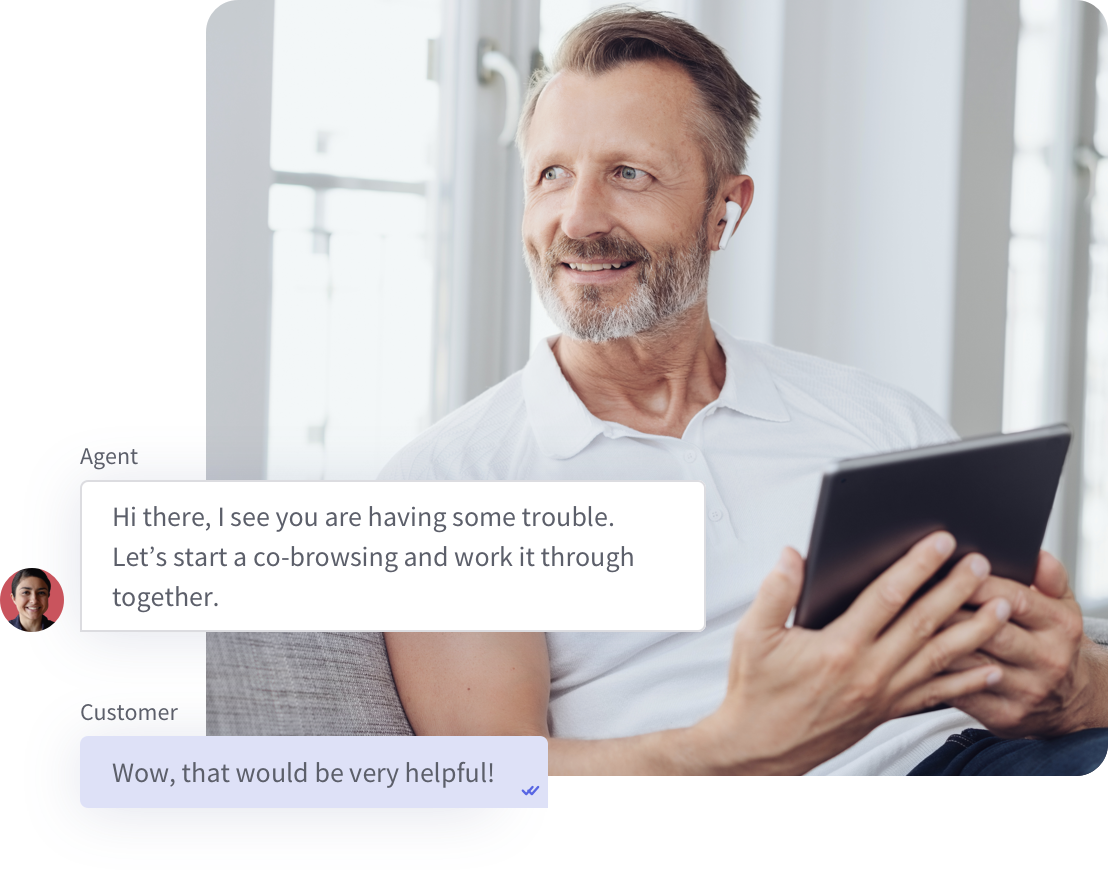

Co-browsing software augments the traditional phone, video meeting, or chat sessions, creating a secured digital meeting room where agents and customers can collaborate as flexibly as they would in person.

The functionality of co-browsing is best understood by thinking about it in practice. Imagine a client and an agent in a video call. Here’s a typical step-by-step of how a co-browsing session might look:

This is just one example of a customer journey supported by a co-browsing session. You can check out our recent post for more on the solution’s functionality and use cases.

How is co-browsing different from screen-sharing?Today, making remote meetings more interactive is a key focus for leveling-up customer service. The two main tools that offer on-screen collaboration in video meetings are simple desktop sharing through a screen-share tool, or a secure co-browsing solution.

Unblu offers both, but we’ll always recommend opting for co-browsing. Only by using co-browsing technology can customer service agents and advisors achieve limitless live engagement while staying 100% secure.

To put it into perspective, let’s take a look at the core differences between co-browsing and screen-sharing

| Comparison | Unblu Co-Browsing | Screen Sharing |

|---|---|---|

| Nothing to download or install | ||

| Can be integrated in existing app | ||

| Highlight the user’s screen | ||

| Securely limited to the browser | ||

| See the entire screen | ||

| Doesn’t slow down bandwidth | ||

| High Quality | ||

| Works with iFrames |

Co-browsing offers a wide range of benefits for the customer, agent, and financial institution who use it. Here are the core benefits for each specific use case.

Customer onboarding

Positive first impression

Deployed during the first point of contact with a financial institution, co-browsing sets the right tone for the customer-agent relationship through a real-time experience. It can speed up the process drastically, helping to ensure a successful conversion and creating a strong first impression of the bank, wealth firm, or insurance company.

Limit drop-off rates

Co-browsing makes informative customer onboarding painless. Applications of co-browsing contribute to lower drop-off rates, making it easier for incoming customers to complete the online process quickly and efficiently.

Customer support

Resolve customer issues faster

With co-browsing, customer support agents can both show and tell, adding a new dimension to the exchange. Visual context and collaborative capabilities lead to decreased average handle time which saves the customer stress—and your support teams’ resources. Implementations of Unblu co-browsing for customer services can result in up to a 50% reduction in support costs.

Create loyal customers

Co-browsing is a simple way to engage customers and creates a space for personalized interactions. Such a human-centric solution has a natural effect on customer loyalty and promotes repeated visits.

Better resolution times

Co-Browsing improves the contact center experience via more efficient service. Implementations boost first-call resolution scores by up to 25%, with a 16% reduction in future support calls on average. It also cuts down the time taken to work through an issue as agents can provide hands-on guidance during a digital customer experience.

Sales

More conversions

Implementations of Unblu’s co-browsing solution tend to result in 3x more conversions. Agents can engage with customers at the right time, turning potential obstacles into high-touch customer interactions. Guiding them through the process can make a huge difference to online conversion rates and repeat sales.

More selling opportunities

Co-browsing transforms how agents interact with customers. By combining with audio or video chat, agents can take advantage of cross-selling and upselling opportunities in a way that is relevant to the customer. As a result, users of Unblu co-browsing can expect to see a 20% increase in total transactions.

Advisory

Remote one-to-one advice

Co-browsing makes it possible to deliver expert and personalized consultations to customers in any geographical region. Giving your customers an experience that equals that of a face-to-face meeting is vital for more complex advice and, in wealth management settings, maintaining a strong client-advisor relationship.

Is Co-Browsing safe?We’ve seen how co-browsing can enhance the quality of customer service in the financial services industry—but there’s still the question of security. For all its benefits, using third-party software can also present major issues for security if not properly implemented. In the financial sector, compliance and identity authentication must be matters of priority.

Fortunately, Unblu co-browsing software is designed to meet the highest international compliance and security standards. As a snapshot:

To discover more on the advanced security features of Unblu co-browsing, head over to our dedicated post here.

Co-browsing implementation: Checklist for financial servicesOn-premises and in the Cloud

Unblu can deliver an on-premise or cloud deployment of co-browsing—it’s up to you. Our financial cloud is fully ISO 27001 certified and SOC 2 compliant.

Render protected resources

Unblu provides a standard software component called the SecureFlow Manager which securely captures session-specific, protected, and encrypted resources. This way co-browsing is possible even for highly protected environments such as e-banking applications.

Masking sensitive data

By tagging elements of the website, Unblu Co-Browsing excludes sensitive customer data and skips any pre-defined elements from the capturing process. This makes it possible to hide information such as credit card input fields or personal details, which is never transmitted from the customer’s browser to the Unblu server.

Integrations

Unblu co-browsing can be integrated into almost any system by using our set of APIs and webhooks. As a trusted technology partner of over 160 financial institutions worldwide, we have a lot of experience integrating our solution into call center applications, CRMs, and external messaging platforms.

Runs on mobile

Your customers are mobile—so you be too. Unblu’s mobile SDK gives you the option to natively integrate co-browsing into an existing app or create a separate one if you choose.

Rapid implementation

Unblu has a proven co-browsing implementation methodology to meet the needs of financial services organizations. Through this methodology, we have been able to set up a fully operational system for our customers in under a month.

How does co-browsing work in practice?

Discover how one of the leading Swiss banks implemented co-browsing for improving support and promoting transactions in this infographic.

Why is co-browsing such a popular solution for customer support?

Co-browsing provides the customer support agent with a powerful visual tool that helps to resolve doubts quickly and meaningfully. The knock-on impact of this is lower resolution times, fewer future calls, and reduced customer support costs.

Will co-browsing integrate with existing contact center systems?

Unblu co-browsing can be integrated into almost any system. We have a lot of experience integrating co-browsing into different systems and environments, and our knowledgeable team will work with you to find the best solution for implementation.

Reinvent the capabilities of your customer support teams and advisors with Unblu’s co-browsing solution. By combining personalized communication with visual engagement tools, you’ll deliver an interactive experience that seamlessly satisfies your customers’ needs.

Unblu co-browsing technology is a tried and tested way to cut service costs while customer engagement soars. Discover how co-browsing could give your services a competitive edge by booking onto one of our product demos today.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice