Unblu joins Central 1’s Forge Community adding innovative capabilities to enhance customer experience

Unblu, an award-winning provider of conversational banking solutions, and Central 1, the leading financial services platform for credit unions and small financial institutions, today announced the onboarding of Unblu to Central 1’s Forge Community platform.

Today Unblu joins Central 1’s Forge Community, an innovative platform designed to foster the collaboration, creation and deployment of new digital solutions for Central 1 members and clients.

“Central 1 is one of the leading innovators in the Canadian financial services marketplace and we’re excited to work with them in launching proven, effective solutions that enable their clients to improve the manner in which they engage with their clients across all digital channels,” said Lisa Joseph, President of the Americas at Unblu.

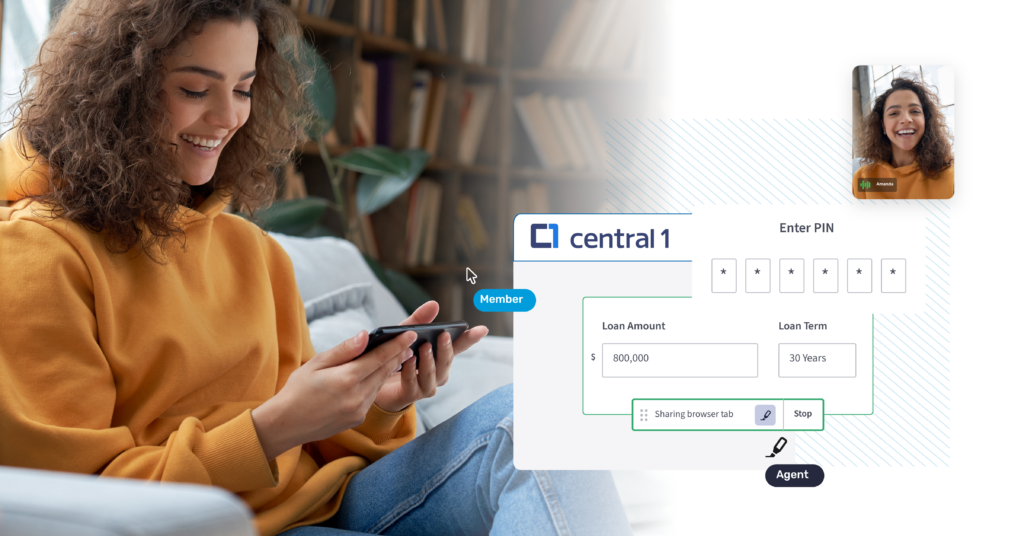

Unblu specializes in conversational engagement and offers various communication functionalities such as messaging, video, voice, and co-browsing. By integrating these capabilities into the Forge Community, Unblu aims to provide credit unions and financial institutions with robust, efficient, and personalized ways to interact with their customers across any use case, at any time, and across any device.

This partnership opens future collaboration opportunities between Unblu and financial institutions, which can benefit from Unblu’s engagement platform, improving overall customer experience.

“The financial services industry is evolving rapidly to meet changing customer needs,’’ said Erick Wong, Central 1’s Chief Product Officer. “We are delighted to welcome Unblu to our Forge Community where innovation and collaboration are empowering our members and clients with competitive products and solutions to help them thrive in today’s dynamic marketplace.”

About Central 1

Central 1 Credit Union (‘Central 1’) cooperatively empowers credit unions and other financial institutions who deliver banking choice to Canadians. With assets of $11.9 billion as of December 31, 2022, Central 1 provides critical services at scale to enable a thriving credit union system. We do this by collaborating with our clients, developing strategies, products, and services to support the financial well-being of their more than 5 million diverse customers in communities across Canada. For more information, visit central1.com.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice