According to a report by Forrester, improved customer experience and higher revenue growth are the top drivers for organizational transformation. Yet rather than building a coherent digital transformation strategy, these significant investments are not having the expected results. As Forrester points out, while they’ve raised their ‘digital maturity’, few financial firms are yet ‘digital masters.’

Those technology leaders charged with digital transformation tend to prioritize tech and process investments over sales and marketing. Similarly, business leaders and their IT teams are often on different pages when it comes to digital transformation strategies.

This disconnect is partly due to the fact that individual departments frequently operate in their own silo, starting their own digital initiatives without considering how they might factor into a company-wide digital shift.

The COVID-19 pandemic, and the sudden rush to embrace digitization and accelerate transformation, have also led to organizational inefficiencies and breakdowns in processes.

Trigger emotions, build relationships from the start

Successful digital transformation is not just about high-tech processes. Driven by digital experiences outside banking, customer expectations now include speed, transparency, convenience, and personalization.

Establishing trusting relationships depends on generating the right emotions. The client needs to feel that their advisor is looking out for them at every step, not just in one-off transactions.

And so companies need to interact with consumers throughout the customer lifecycle, in both digital and physical interactions, showing they understand and care at every moment.

Whether firms are providing early educational contact or helping clients compare different financial products, each interaction should be positive, providing meaningful support and building trust.

Digital capabilities and customer demands

The needs and demands of consumers vary throughout the customer lifecycle. They may not derive the same value from particular digital capabilities every time they interact with their provider. Digital transformation strategies should therefore take into account that customers seek different digital touchpoints depending on their expectations at that time.

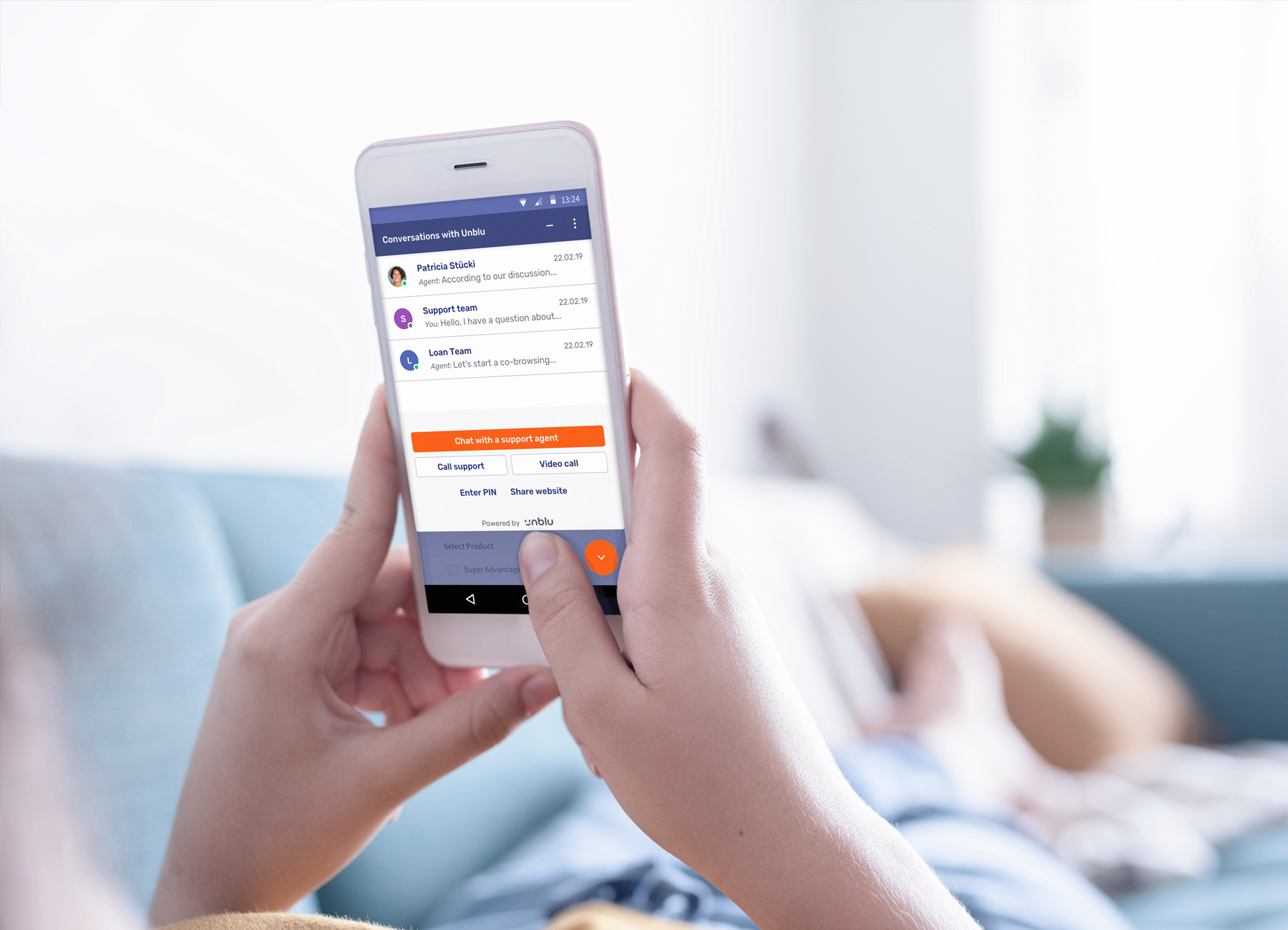

In fact, 71% prefer multi-channel interactions. A flexible and omnichannel service that incorporates different tools and touchpoints is one that aligns digital capabilities with the customer journey. Customers might move from talking to a chatbot to speaking with an advisor via video call, for example, and maybe even use co-browsing too—without having to share their details each time or repeatedly update different agents about their problem.

And so digital transformation—or mastering digital banking— is not simply a question of building a better tech foundation. To achieve their business objectives, improve the customer experience, and boost revenue, financial firms need to adapt their organizational structures and develop new skills.

Digital transformation disrupts both how people work and how they think about their work. Therefore, any digital initiative needs to be combined with a shift in mindset as well. For example, you need to make sure that your new chatbot for mortgage inquiries is truly valuable to the customer, rather than just assuming, and be prepared to educate your employees in this new way of thinking.

To become ‘digital masters’, financial service firms need to look beyond tech investments. Digital transformation entails a whole-scale organizational change and providers must focus on prioritizing the customer’s needs and delivering a positive experience at every stage of the journey. By aligning digital tools and touchpoints with the customer journey, responding to customer needs in that particular moment, banks can provide a digital experience that consistently and successfully delivers value.

Assess your Digital Banking Capabilities whitepaper

Learn to align touchpoints with the customer lifecycle, discover best practices and use cases, and find out which digital capabilities to focus on based on your digital maturity assessment. Download the whitepaper today.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice