Exponential technology in reshaping the bank-customer relationship and re-imagining the customer experience. As partners at the forefront of this customer experience revolution, the unblu-GFT partnership offers insight and expertise on how financial services can leverage the technology.

unblu was pleased to host Ignasi Barri, GFT’s Business Development and Innovation Director and Ricardo Elizo, GFT’s Digital Innovation Sales Director in this interesting conversation that covers the big picture of disruption to the business-changing benefits for unblu-GFT clients.

Exponential technology is being used all around us, Ignasi points out at the beginning of the discussion, disrupting everything from how cars are driven to how 3D prosthetics are used in war zones. He explains how exponential technology is unleashing the concept of Moore’s Law in banking – that consistent technology improvements will double service levels and cut costs in half every two years. For the skeptics who wonder if exponential technology can truly transform banking, he refers to Korea’s digital bank Kakao. The bank acquired 300,000 new clients within a 24-hour launch period in 2017, and almost half of the country’s market share in less than a year.

Ignasi defines the exponential bank as:

- Customer-focused, rather than focused on selling products and services

- Tech savvy and ready to embrace different platforms for promoting products

- Operationally efficient, freeing up people to use their talent on more valuable work

- Data driven at its core, using data to help customers make the best decisions

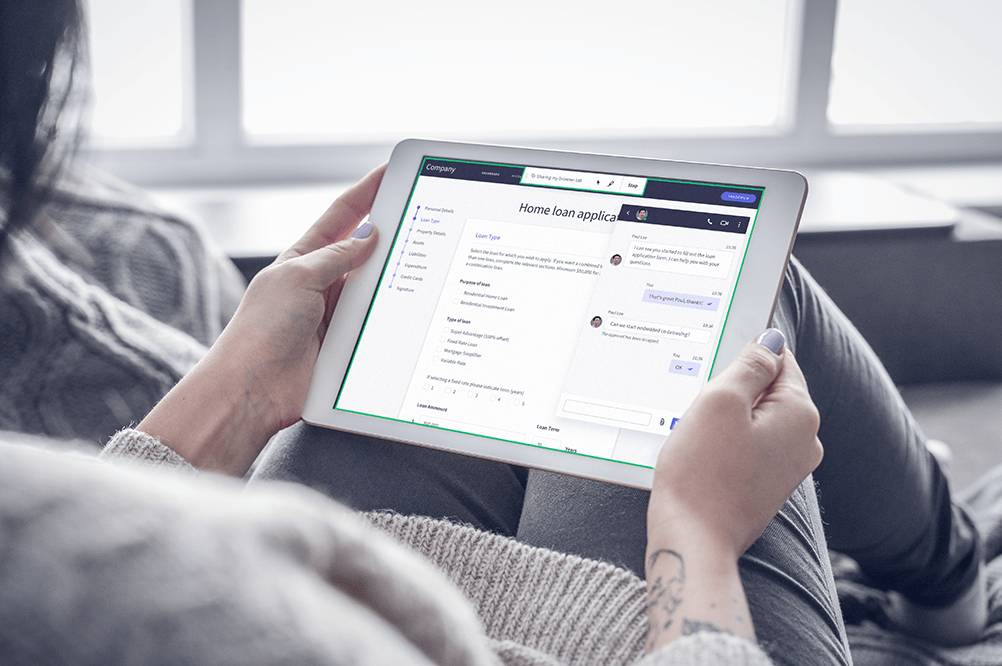

To show how these characteristics are working for GFT-unblu clients, Ricardo presents two use cases from the banking and insurance industry. In the banking use case, Ricardo explains how the customer was set up to use both proprietary data as well as data from other sources, to create a personal experience for customers. In terms of benefits, customer support time was reduced by 20%. Both customers and staff are reporting more satisfaction in better service delivered.

With the insurance use case, unblu and GFT are working with the client to support digital engagement between agents and clients, which will save countless hours commuting time for agents. This will cut costs for the company, reduce the errors that come with manual inputs, and boost engagement with the customer.

Join in the discussion and find out how financial services can push through their digitalization efforts to improve their customer experience while lowering their operating costs.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice