Investing in digital transformation can be like walking a tightrope of hopes and fears. There’s excitement to be undertaking a new initiative, whether it is developing an in-house application, or deploying a new analytics tool. And with new investment, generally comes hopeful optimism for success. But there’s also a whole lot of worry – how will we manage the switch from legacy systems? Will the siloed data actually seamlessly merge? When will we be able to prove the ROI to the board? And how are we going to keep customers happy during this massive overhaul?

When the bank implements the initiative, the technology performs as promised. But the hoped-for gains in convenience and ease for both the customer and the bank doesn’t materialise. Even worse, lag times may increase and the customer experience could suffer. So what went wrong?

Many transformation initiatives fall flat because the bank overlooks the critical mission of changing and managing the culture into a digital culture – and that can make or break the transformation effort.

But isn’t technology supposed to make things easier, cheaper and faster?

Part of the problem begins with the mentality in the industry that technology is a quick fix to make things cheaper, faster, and more efficient, the “let’s build an app” approach to fixing a business problem. While an app can make it easier to deliver a business strategy, the problem runs deeper. Just implementing technology doesn’t resolve the business issue. Banks tend to focus on how technology will change their business, rather than how the organisation itself needs to change to unleash the full potential of their digital initiatives. Technology is a key component of a digital transformation, but it’s not the only component.

Ignoring culture can mean transformation failure

A survey by McKinsey & Company of global executives asked them to outline their biggest challenges in implementing digital priorities. One-third of respondents put cultural and behaviour challenges at the top of the list. The report states that the financial services surprisingly still lags in digital technology adoption, with penetration across the industry just recently approaching 40%.

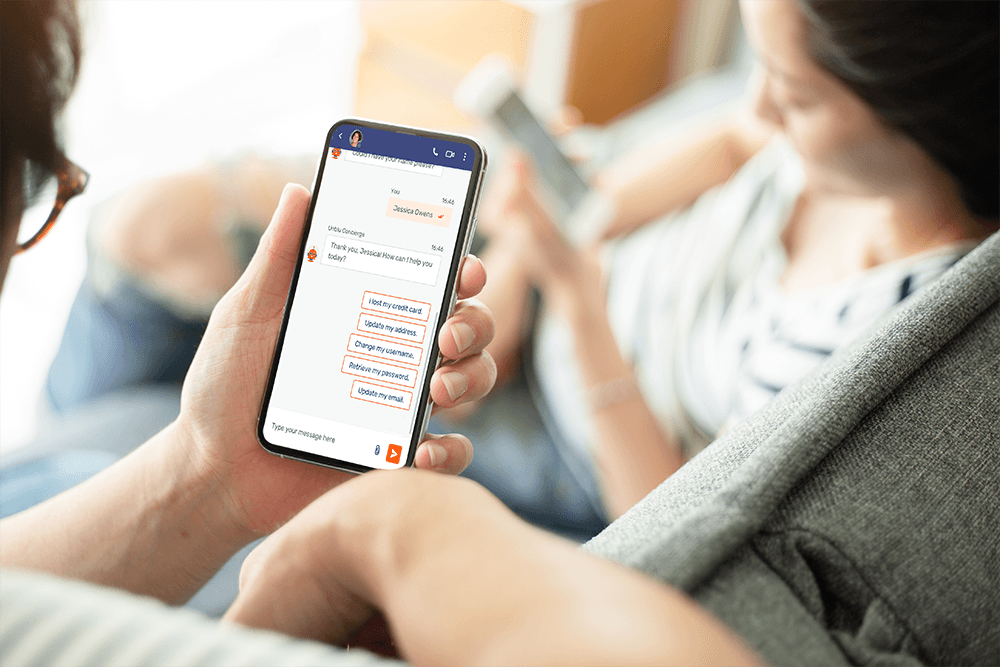

True digital transformation requires more than technology. It’s more than a digital façade that looks like a digital experience for the customer, when in reality, the back-office can’t support that level of digitisation. For example, in an effort to make loan applications more convenient, customers can initiate the process through a mobile app or online. The customer sends the information to the bank with much greater ease and speed, but that is of no benefit to the customer. It still takes three weeks to approve or decline the loan request because the legacy back-office process doesn’t work at the same speed as the digitised customer-facing tool. This leaves the customer either confused or frustrated – because they’ve kept their part of the bargain to make the process automatic and faster by using digital tools, but the bank can’t deliver on their end because of old ways of working on the back end. It’s experiences like these that can cause a customer to look at what the competition can offer them.

We know that culture is the most important enabler of digital transformation. Without people, tools can’t make any real difference. If you still have doubts about the intrinsic connection between culture and digital transformation, check out the historical analysis by MIT Sloan and Deloitte on who leads and who fails when it comes to technological advancement. “The history of technological advance in business is littered with examples of companies focusing on technologies without investing in organisational capabilities that ensure their impact…failures are classic examples of expectations falling short because organisations didn’t change mindsets and process or build cultures that fostered change.”

According to research by Boston Consulting Group, an organisation that ignores culture risks transformation failure. BCG assessed over three dozen digital transformations and found that companies who focused on culture reported financial performance five times greater (90%) than those who neglected culture (17%). The case for nurturing digital culture is even more compelling when it comes to their sustained performance; nearly 90% of companies that focused on culture sustained strong financial performance. In contrast, not one of the companies who had neglected a cultural focus achieved such performance.

It takes time, commitment and discipline to align culture and technology. Financial institutions need to make the time and space for their employees to build community by sharing experiences, collaborating and learning what works.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice