Like so many paper-heavy and agent-led industries, digital innovation is fast disrupting the insurance industry. It’s a double-edged transformation that is not only changing how insurance is done but also reinventing customer expectations. And in boardrooms across the sector, customer experience strategists are grappling with what Forrester terms ‘hyperadoption’: the uptake of new consumer behaviors at an unprecedented pace.

In the day-to-day of insurance, key tasks such as underwriting risk, selling policies and managing fraud are taking on digital dimensions, also giving rise to virtual channels for customer support. With new competencies come new competitors—and in insurance, those with digital prowess are quickly gaining a powerful edge.

Nonetheless, there are still major obstacles to navigate. Digital insurance experiences must be well-designed and strategically executed, finding ways to tackle a myriad of difficult security and data issues.

While the emergence of new insurance technologies are optimizing individual tasks, end-to-end digital insurance experiences are harder to come by. Delivering a seamless insurance customer journey complete with digital touchpoints therefore represents a promising avenue of opportunity. Here are the tools and customer experience strategies to watch.

Considering the whole customer journey

Smart leveraging of digital isn’t just about technical competencies. Firms must begin by crafting a holistic vision of the customer journey, identifying interconnected touchpoints that can then be augmented by digital experiences. According to McKinsey, customers require multiple access points for interacting with their insurer through their journeys.

By way of digital innovation, comparison websites have already raised the bar during the purchase journey, giving buyers a 360° overview of the market at the click of a button. In the past year, 66% of UK car insurance purchases were researched via comparison websites, a fact that has narrowed the profit margins of insurers’ who aren’t willing to implement digital enhancements. Those blazing that trail—Hublio in Ireland or The Zebra in the US, for example—use digital tools to help customers get the best deal for their insurance coverage, swiftly leading to cross-market visibility.

Flexible and tailored product offering

Digital innovation has also given rise to the atomization of insurance, which means that customers now have the option of buying short-term, flexible covers. Having identified an untapped audience among infrequent drivers, UK-based online broker By Miles uses driving data to let customers pay for their insurance by the mile. Plus, they offer in-app services such as car inspection reminders.

Leveraging personal data is also causing a stir in other areas of insurance, with insurtech startups finding great success in using digital devices to enable personalized coverage. Hippo Insurance is a leader in this regard, offering customers smart-home devices to collect data that protects them from fires, water damage, and burglaries. As well as making homes safer, this model gives customers the possibility of data-evidenced savings on their premium by curtailing household incidents.

Digital advice brings the insurer-customer relationship closer

The need for a new insurance product is often brought on by major life events, such as moving houses or raising a family. For that reason, tailored advice is likely to resonate best with both existing and new customers.

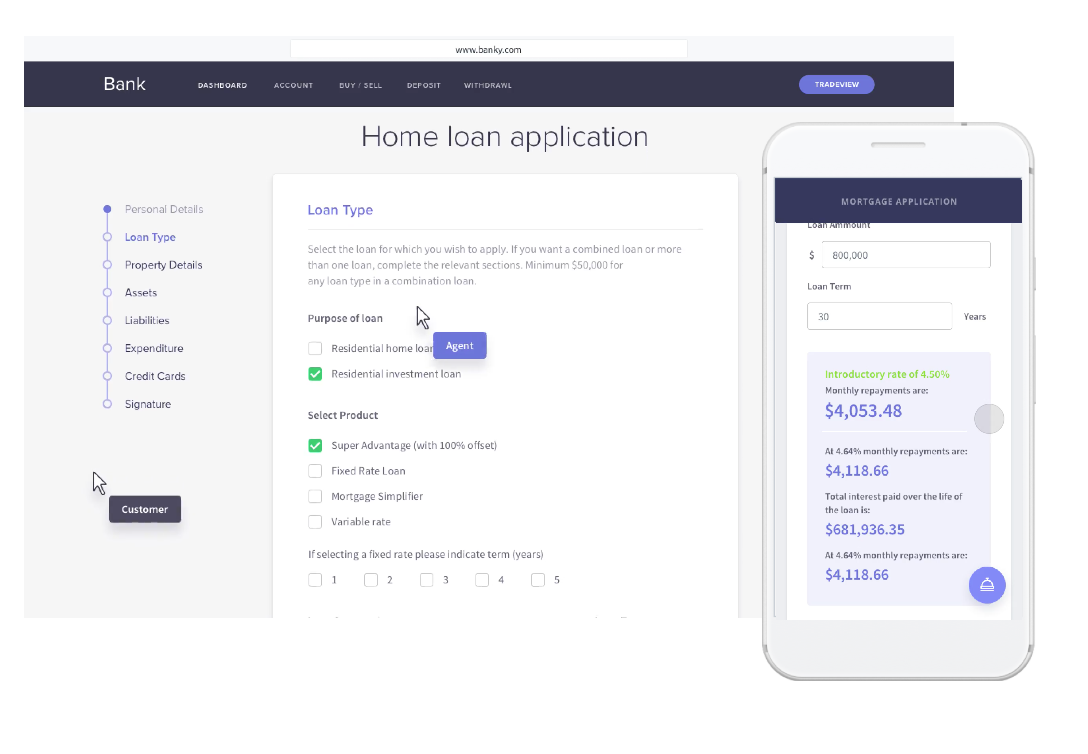

Insurance customers consider service quality and trusted advice from an agent to be an important component of their purchase decision. Fortunately, there are multiple digital solutions that deliver the convenience of digital without creating distance between the advisor and the customer. A video call supported by a co-browsing tool and scheduling capabilities, like Sanitas has implemented in Switzerland, replicates the functionality of an in-person meeting, guiding the customer through the end-to-end process in challenging moments like purchasing insurance products.

AI-powered underwriting, claims, and customer service

In the new age of personalized services, the potential of AI and machine learning cannot go amiss. Through continuous learning, AI technologies are able to generate next-level recommendations by analyzing individual behavior and new data, such as a recent life event. Firms should look to leverage AI in conjunction with their existing assets, using it to deliver initial advice or assist the evaluations of a human advisor. While tailored advice is sure to strike a chord with today’s insurance audience, customers aren’t set to dismiss the value of human conversation anytime soon.

As applied to everyday insurance processes, disruptive uses of AI-powered automation of underwriting and claims make customer experiences more convenient—all while cutting down overhead costs. Clearcover, a US digital insurer, has developed an AI-based claims process that can rapidly approve coverage and fast-track payments for eligible claims. That means the process can be carried out through a handy mobile app, from filing the claim to receipt of payment.

Low-effort experiences simplify insurance

Keeping the effort required of customers to a minimum requires an integrated insurance journey. Digital touchpoints are ideal, but they are not enough in isolation. Customers should be able to move seamlessly between channels—and for this, insurance disruptors are calling on smartphone cameras, video functionalities, and API data to streamline insurance interactions.

One compelling industry case is UK startup Cuvva, who offer an app-based sign-up, quote offer, and coverage purchase process. Avoiding the need for lengthy application forms, customers send a picture of themself, their driver’s license, and their vehicle, which is aggregated alongside app-collected geolocation data and government data. The entire process can be completed in a matter of minutes.

Of course, it simply isn’t possible to make all processes instantaneous, but integrated and digitally-powered customer journeys do make complex issues easier to resolve. Where technical assistance is needed, an initial message can easily evolve into a video call, supported by co-browsing to give visual context. Using Unblu’s embedded co-browsing solution, multinational firm AON and Swiss local insurers such as Smile, Helvetia or EGK, have empowered support agents to resolve issues quickly and accurately. In the event that it’s an issue for the IT team, reps can take a screenshot and open a ticket—curbing the previous need for customers to identify and communicate their issue.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice