Customers want to have the choice of contacting their bank in person or through digital channels – or a mix of the two.Whether it’s walking into their branch or having a web chat on their tablet, people are now using more than six channels on average to keep in touch with their bank. But they still want human help – probably a lot more often than banks realize.

To deliver this choice, financial institutions have to ensure their digital transformations are hybrid, sometimes referred to as “bionic” – part human, part robot. This enables the customer-centric interplay of the personal human touch that provides reassurance, advice and trust with the convenience and efficiency of digital products and services. A hybrid approach allows the customer choose when they want to conduct banking activities solo with occasional guidance from a bot or virtual assistant (if they choose) and when they need to look a trusted advisor in the eye.

It is critical that every self-service digital interaction leads to a human. Otherwise customers can be left stranded, without a pathway to human help. Recent research indicates that digital self-service interactions often fail for customers, from basic interactions such as making an appointment to see a financial advisor or making a complaint, to managing investments online and making changes to insurance policies. When customers want to do more complex things beyond checking their balance and paying bills, things get “hard”. Three-quarters of customers have problems buying financial products online. Managing investments and filing complaints are ‘not easy’ and it can take five attempts at contacting the bank to make an appointment with an advisor online. This could explain why 85% of respondents want phone support to be available alongside digital service. In short, respondents want help from a real person, especially when something goes wrong and guidance and reassurance is needed.

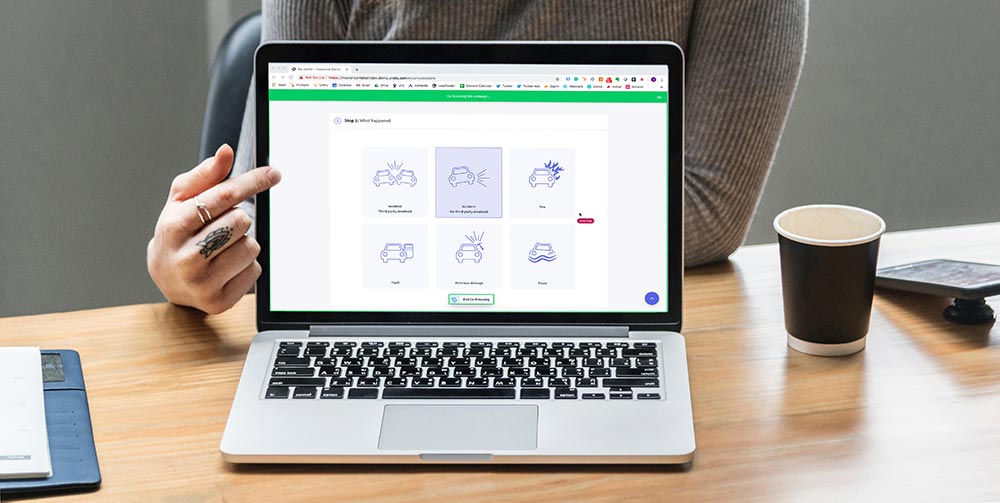

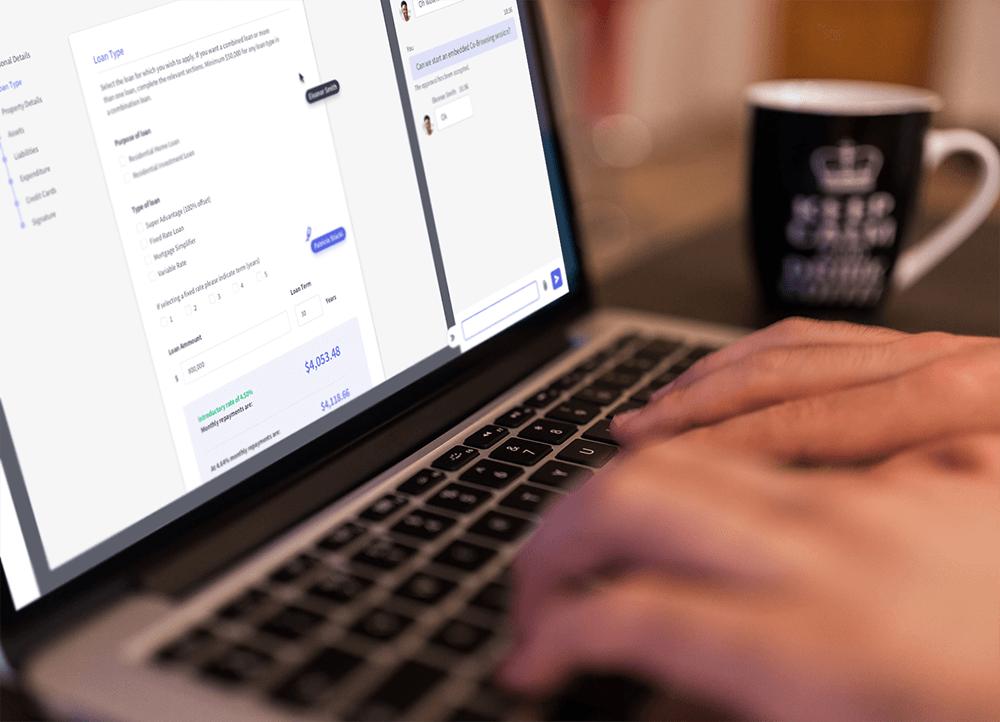

A hybrid approach makes human conversation available for every online interaction, on every channel. With a conversational interface, the customer moves seamlessly between texting, voice conversations, and video chat, while using digital tools such as co-browsing and document sharing to make things easier. This range of interaction re-creates a face-to-face bank branch meeting. The customer chooses how they want to interact and if they want human interaction, which, with the right digital solution, can be one click away.

The future is pointing to fast-paced transformational growth within the industry. We have the technology and know-how to eliminate each source of friction for the customer. And once customer frictions are resolved, new challenges will surface, no doubt – but a hybrid bank can handle it.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice