Insurance companies are increasingly under pressure to acquire customers via digital channels. But for many, optimizing conversion rates while keeping things cost-efficient is a trade-off, causing companies to go in one of two directions. Either they invest heavily in self-service to minimize operational costs, or they resist digital demands and cling on to traditional means of customer interaction.

Of course, modern customer profiles will each have their own digital preferences. Some might be content to carry out routine tasks via an app or chat agent, while others may feel more comfortable talking with a consultant directly. But whatever the skew of preferences is, delivering a personalized experience is essential to customer satisfaction.

Introducing multi-access insurance

It’s for this reason that multi-access is becoming the strategy of smart insurance providers. In reality, most digital insurance journeys don’t consist of just self-service, or just remote interactions. Self-service may be great for certain needs, but insurance customers must always feel that human help is there for them—be it in-branch or via their mobile app.

For all their unique preferences, customers seem united in the fact that they want the element of choice. The appropriate response is a mix of digital and in-person channels, providing customers with the option to use either or both when the situation calls for it. Only by building an ecosystem of interconnected channels can insurers expect to meet the vast array of customer expectations and needs.

The multi-access customer journey

Embracing a multi-access mentality also entails a shift in the way we approach customer journey mapping. In the contemporary customer service universe, communication is rarely with a single broker. Multiple touchpoints are used at every stage of the digital customer journey.

On the first level of the customer journey map, we have self-service engagements for low-complexity, low-margin products and tasks that don’t require specialized advice. A good example of this is online claims reporting. Historically an offline process that entails endless questions, a good digital self-service can improve this dramatically. In particular, using data and AI to tailor questions to specific contexts can reduce the time taken to register a claim, boosting the overall customer experience (McKinsey).

We then have hybrid methods of engagement. While digitally-savvy customers might wish to complete a claims process independently via online services, every customer should have the option to contact a customer service agent for help at any point throughout the journey. This might be a live chat, phone call, or video meeting with a real insurance advisor. They’ll be able to receive advice and complete the transaction, all online.

The hybrid method of engagement also offers a strategy for managing more complex areas along the customer journey map, such as onboarding or policy renewal. In these instances, even highly knowledgeable customers will probably benefit from real-time support from a specialist at some point in the purchase process. By making communication channels such as video and voice calls accessible at any time, customers feel supported by a personalized service while also doing things on their terms.

Even in a time of unparalleled digital advancements, we can’t forget the face-to-face channel. It may be possible to shift all insurance customer engagement into the digital realm, but many will still appreciate an opportunity to meet with their insurer in real life. As an experiential service, this format has a unique dimension of personalization, so insurers should take opportunities for face-to-face interactions where they come. Undoubtedly, it is still a relevant part of a multi-access insurance model.

In practice: A multi-access use case for insurance sales

Unblu is a multi-access solution for insurance experiences. As an interconnected platform of communication features such as live chat, voice calls, video meetings, and co-browsing tools, Unblu provides a digital architecture for integrated, compliant, and flexible customer experiences.

Insurance agents around the world depend on Unblu to deliver the initial stages of their customer journey and sales process. Our features are designed for use specifically in the financial service industries. Among our insurance clients, Unblu is instrumental in helping firms to build streamlined and user-friendly policy purchasing experiences for their customers.

Step-by-step: Insurance use cases

1. Online meeting scheduling

A potential customer is traveling home from work on the train and wants to investigate some options for their life insurance cover. Contact forms are an easy way to get the ball rolling, but they don’t cater to those users who are ready for a stronger engagement, spelling missed opportunities. On the other hand, call centers might be asking too much of a customer at an early stage. Many are put off by the idea of speaking to a stranger over the phone, and very few will tolerate being put on hold in a call queue.

Online meeting scheduling gives customers an actionable yet easy option for their first contact. Integrated into the public website, the customer can simply pick a time and an advisor to suit their needs. That way, the meeting is on the calendar and the customer hasn’t wasted any time.

2. Meeting preparation and admission

Once the prospective customer has selected their time slot, the advisor is notified of the booking. Until the time comes, the agent can prepare the conversation. Based on the information the customer has submitted, they might upload files, bookmark a website, or prepare a document that they want to share during the meeting.

The customer is only admitted into the conversation when the agent starts the meeting and lets them in. To begin, the customer and agent simply go to the calendar invite that contains the link to the meeting, which can be done on either desktop or mobile.

3. Video and voice collaboration

The customer has the option to do the meeting with Unblu’s video or voice tools. This will never require any downloads for the customer, giving them a seamless experience while also reducing malware threats. Video in particular is also a valuable vehicle for remote face-to-face conversation, accelerating the sales process by providing a more personal service. The customer can have the video as a pop-out, running alongside the co-browsing window.

4. Co-Browsing session

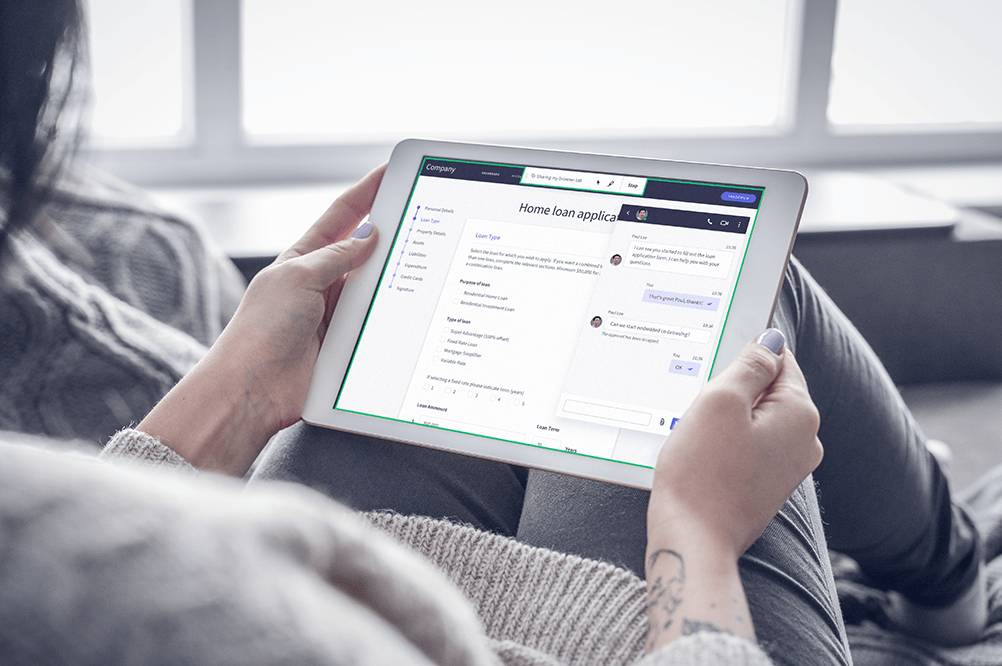

At a certain point, the customer and agent may come across a topic that would benefit from visual representation. It might be some information on a public website that the agent wishes to share, or perhaps a piece of documentation that the customer wants help with.

This is the ideal moment to launch a Co-Browsing session. Co-browsing is a digital tool that slots in seamlessly to video and voice channels, where the customer can keep viewing the video as a pop-out that runs alongside the co-browsing window. Once launched, they can review documents together, fill in forms, and even sign contracts.

Among Unblu’s existing clients, we’ve seen these collaboration functionalities generate a four-fold increase in the number of meetings per consultant, reduce the duration of meetings by 25%, and increase the conversion rate by up to 20%.

5. Digital signature

Once the customer has decided on an insurance policy or insurance product, e-signature software such as DocuSign can be integrated into the customer journey. For Unblu users, e-signing is simple and streamlined, with no need for tab-switching or downloads. This allows the application, sales, or renewal process to be concluded entirely online, offering the customer a convenient and flexible digital tool to take care of their policy.

6. Security and compliance

To comply with all the financial regulations, such as MiFID 2, all interactions that take place in Unblu are encrypted and stored securely, and can be recorded as well. Any relevant documentation will be sent to the customer and kept in centralized storage for compliance purposes.

Unblu optimizes digital insurance journeys

Superior customer experiences are those that leverage digital in the interest of customer centricity. Today, that means giving them plenty of touch points and plenty of options. Hybrid, multi-access strategies are the way to deliver.

Unblu provides insurers with the digital tools and channels to craft unforgettable multi-access experiences—and foster customer loyalty. We’ve been fusing the possibilities of digital and human in financial services for over 13 years, helping firms realize the goal of efficient interactions that meet both business objectives and customer goals.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice