With demand for online services growing daily, more and more banks are offering digital self-service platforms to keep up with customer preferences. But these relationships can only be partly automated because at the end of the day, a successful digital transformation still requires human interaction.

Digitisation can be a double-edged sword. On the one hand, banks are eager to give the customer their preferences for online banking. But on the other hand, it’s these preferences that are causing personal relationships between banks and their customers to deteriorate. This means lower customer loyalty and potentially missed revenue opportunities. With less access to their clients, banks are losing their ability to identify what a customer needs at the right moment.

But what if banks could engage digitally with their clients and retain human interaction at any time? We’ve seen that engagement and collaborative interfaces can help financial institutions increase their assets, reduce their operating costs and improve their overall customer satisfaction. So how does a tool like a collaborative interface make all the difference?

By reducing costs and increasing customer satisfaction with superb online support

With collaborative and customer engagement interfaces such as co-browsing, customers and bank agents can get to the point quicker and improve the resolution time for the issue. Because of these shorter support interaction times, customers satisfaction gets a boost. One more pay-off: by being present with the customer within their context, you can bring the customer a whole lot closer to adopting the bank’s digital channels.

By keeping high-end advice personal

Both regulation and customers are demanding more frequent, transparent, personal and efficient communication with relationship managers. But trust and expertise are still the non-negotiable drivers of the relationship. End-customers still expect a highly qualified human interaction when something important is at stake – but just not at a bank branch.

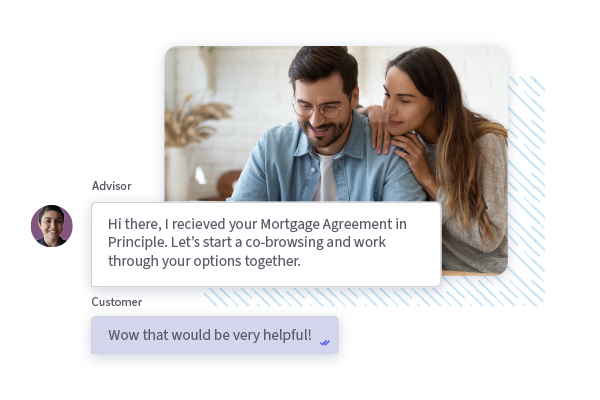

Technology like Secure Messenger application opens a permanent communication channel between the advisor and the customer. With these new engagement and collaborative interfaces, advisors can meet customers online, when it suits them. And as expected – regular, personal communication results in more transactions.

By supporting the moment of truth and closing more transactions

With visual interaction, the customer can receive the right kind of guidance at the right time, particularly when they are about to make a decision. The agent can guide them through unfamiliar applications, products or transactions. Banks can assist prospective and existing customers purchase their products and services at that crucial moment of truth – without losing momentum.

In the near future, traditional banks will have to justify having a physical presence. Their challenge is to offer a high level of customer service using online channels. By engaging with customers and prospects in real time, they can guide customers through this digital journey to the successful completion of a business transaction. But these digital transformation journeys don’t have to be painful. In fact, interface and collaboration tools make them profitable by securing your personal relationships – a truly valuable asset these days .

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice