Customer-centricity has become something of a buzzword in digital banking, and for good reason. The customer is the most important architect of the trends in digital banking today. Yet, many organizations have not prioritized meaningful interactions with their customers.

In fact, few firms have taken the time to unravel what kind of service their customers want. This involves a detailed analysis of the industry, technologies available, and consumer behavior. In the absence of this, CX strategies tend to rely on the idea that all-out automation is best, missing the mark when it comes to engendering trust among their clientele.

Now more than ever, the focus for banks should be human-centered customer experiences—and that means putting an emphasis on empathy.

New players are reinventing the wheel in digital banking

Banks that know their customers must also know their industry. It’s no secret that newer entrants to the financial services space have altered the industry landscape, and with it, the expectations of customers.

Today, the avenues of opportunity opened up by online advertising channels have toppled the monopoly of traditional institutions. Consumers can now choose to bank with a range of smaller players who have crafted their offerings for specific segments.

At the other end of the scale, the arrival of tech giants like Amazon and Google into the financial market are presenting consumers with highly convenient solutions from brands they recognize. Meanwhile, the proliferation of fintech providers is raising the bar for digital experiences, forcing established banks to cooperate rather than compete.

Firms must be acutely aware of developments in the industry, and anticipate how they will affect customer preferences. Being proactive about new demands will help them keep hold of customer loyalty.

Demands have gone digital

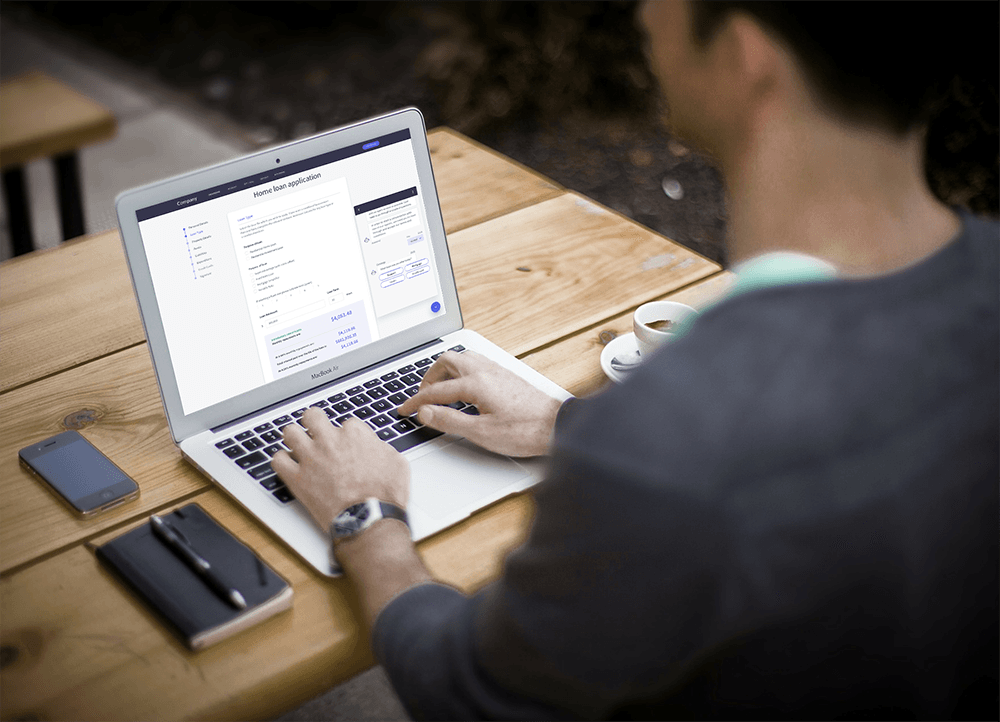

The pandemic was a masterclass in what happens when customer interactions cease to take place in-person. What followed was a mass migration of consumers to digital platforms, digital preferences, and digital habits. And while today’s abundance of technology presents banks with great opportunities, they must think carefully about how to leverage the digital powerful tools on offer.

A key component of this is defining an omnichannel strategy. In a world where mobile connectivity is almost a 24/7 guarantee, banks should be prepared to reach their customers through multiple channels—and switch seamlessly between them. With 50% of customers citing a preference for omnichannel banking, it’s a paradigm that banks cannot afford to miss out on.

Turning more tech into more trust

Digital transformation is paramount, but never at the expense of practices that foster trust. Banks must know that client-centricity is much more than a suite of technologies that leave customers to their own devices. In actual fact, today’s customers want to be served by digital capabilities that are guided by a human touch.

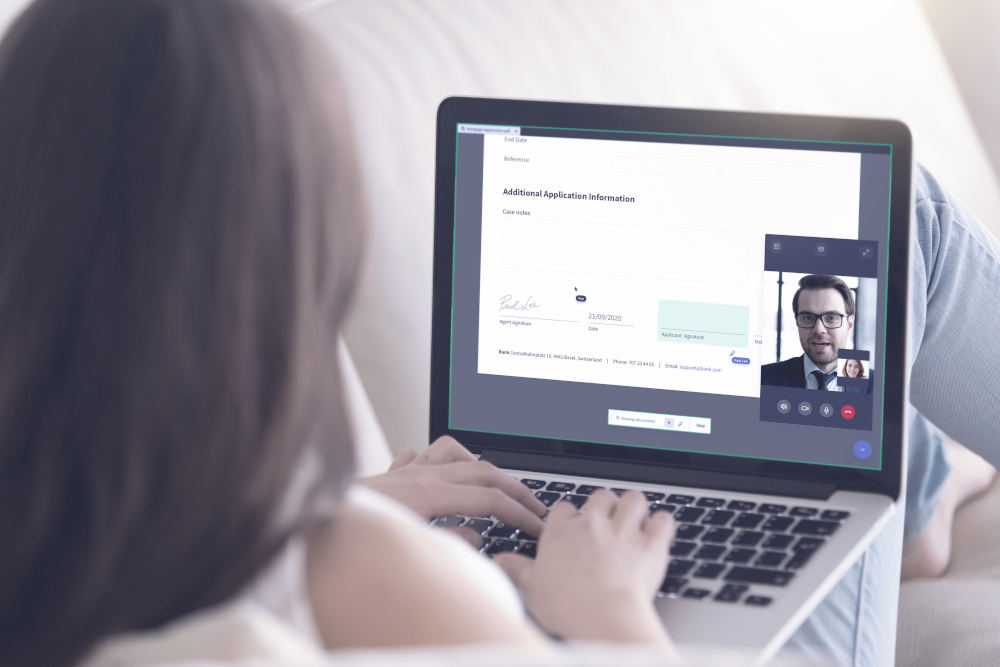

Empathy-driven strategies will also focus on retention and long-term loyalty. That means investing in customers at more advanced stages of the customer lifecycle, ensuring their interactions are as convenient and human-centric as new ones. At every touchpoint, technology should integrate different stages of the customer journey, always leaving the door open to human interaction.

Building a dynamic digital roadmap

In an increasingly complex market, a humanized approach to digital CX can unlock several layers of value for banks. By working to earn customer trust, loyalty becomes a long-term asset, creating a source of sustainable value that can adapt to technological advancements.

When building a digital roadmap, it is therefore wise to make customer-centricity the final destination. Focal points for strategists should be seamless journeys that leverage the “moment of truth”, multiple touchpoints for flexibility and convenience, and most importantly, creating spaces for meaningful customer conversations.

Ready to craft a humanized digital strategy for a new era of banking customer experience? Get started with the facts. Download Forrester’s latest report “Building a Dynamic Digital Roadmap” here.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice