When harnessed to optimize the customer experience, innovations in technology – such as AI or analytics – allow banks to deliver meaningful conversations. Technology has the potential to make banking more efficient, productive, and secure, and to allow advisors to answer queries in real time with customized advice. But technology isn’t the last word. Even while wanting banking to become more digital, customers continue to value human-to-human interaction. The solution? Opt for a hybrid experience where human expertise and capacity for connection meets technology’s power to make interactions quicker, smoother, and more productive.

Top benefits of chatbot support

Customers can find the answer to their query faster using chatbot technology. They can pose their specific question, receive an answer in real time, and do all this in the context of a conversation. This feels far more natural and intuitive than searching FAQ pages, looking for a solution to their unique issue.

As customers are able to resolve their problem faster and advisors can delegate some of their workload to chatbots instead, customer support costs are reduced. Chatbots also minimize the number of drop offs by offering advice at just the moment a customer needs it, removing the additional cost of trying to help a customer who was unable to find a solution the first time around.

Finally, chatbots can handle multiple conversations at the same time, far more than a human advisor can be expected to manage, and this means issues can be solved a faster rate. Each conversation is also handled faster, simply because of the high-tech nature of chatbots who can respond quicker than a human thanks to automation.

Top benefits of live chat support

While chatbot technology is fast and convenient, customers still miss chatting with a real person. Live chat handled by an advisor offers the speed and efficiency of online conversations but also this vital personal connection. It therefore increases customer satisfaction by providing both convenience and a much-needed human touch.

At the end of the day, chatbots can only offer the advice that they’ve been programmed to give. Solutions will always have an element of the generic. When it comes to complex and high stake inquiries, customers will appreciate the chance to speak to an advisor who can offer empathy and reassurance, help them solve their issue, and build a relationship.

Live chat offers advisors the chance to help customers at the moment where they might otherwise become frustrated. This digital disconnect – where customers feel disenfranchised by not being able to speak to a real person – can be overcome by offering clients the chance to speak to an advisor as just the right time, leading to reduced drop off rates.

Chatbot and live chat for a seamless customer experience

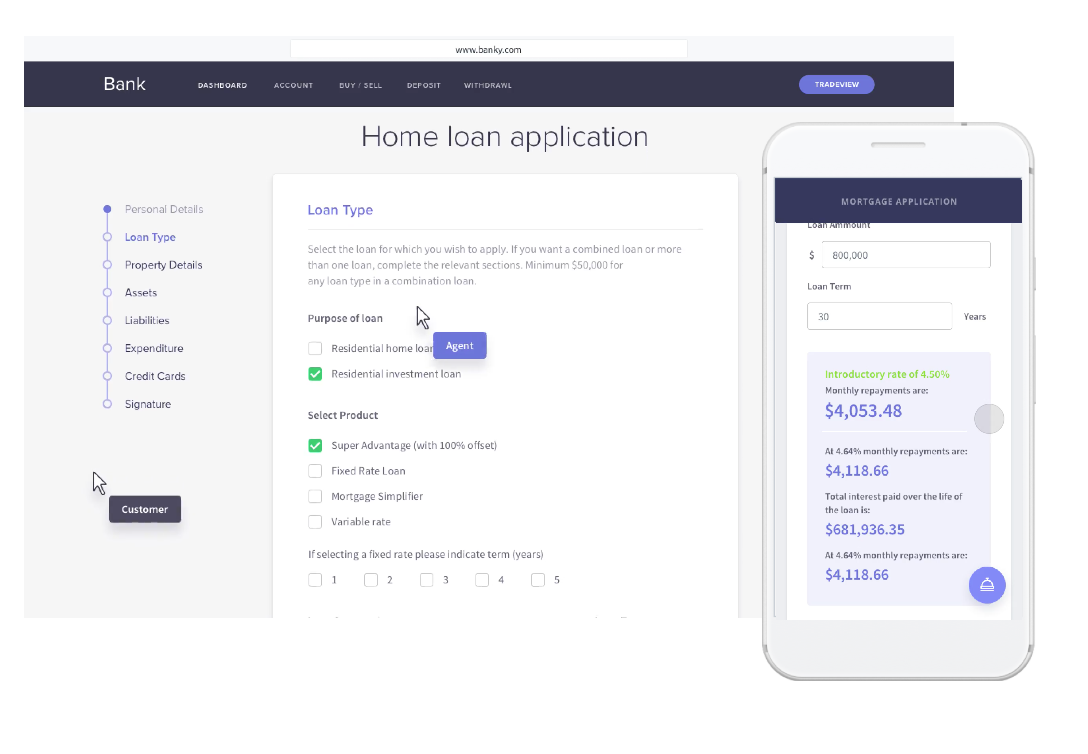

Opt for a hybrid experience by merging bot technology with a live chat solution. Customers can then begin a chatbot conversation but transfer to a human advisor at any time, such as when discussing something complex and sensitive like long term investments.

As for mortgages or insurance products, customers might begin with a chatbot conversation but switch to an advisor before the final decision for added reassurance. This hybrid model also means chatbots don’t need to have every possible answer. If necessary, an advisor can take over.

For everyday banking operations, chatbots can provide guidance at the moment that customers want it and in the intuitive context of a conversation. For simple operations, interacting with a chatbot provides timely, relevant, and engaging advice.

Conversational banking and Unblu

Find the ideal half-way house between the ease and efficiency of technology and meaningful human conversation with Unblu’s Conversational Banking Solution. It’s the perfect pivot between the digital and personal.

Build trust, create opportunities, and optimize customer-advisor relationships with personal advice offered in real time. Book a demo through the product page and an Unblu team member will reach out to advise you.

Interaction Management Hub

Interaction Management Hub Secure Messenger

Secure Messenger Video & Voice

Video & Voice